About Energy Storage Iron Lithium New Energy Stocks

Energy storage companies find ways to store energy for future demand. These firms can be big or small, and the way they store energy may change depending on what kind of technologyis.

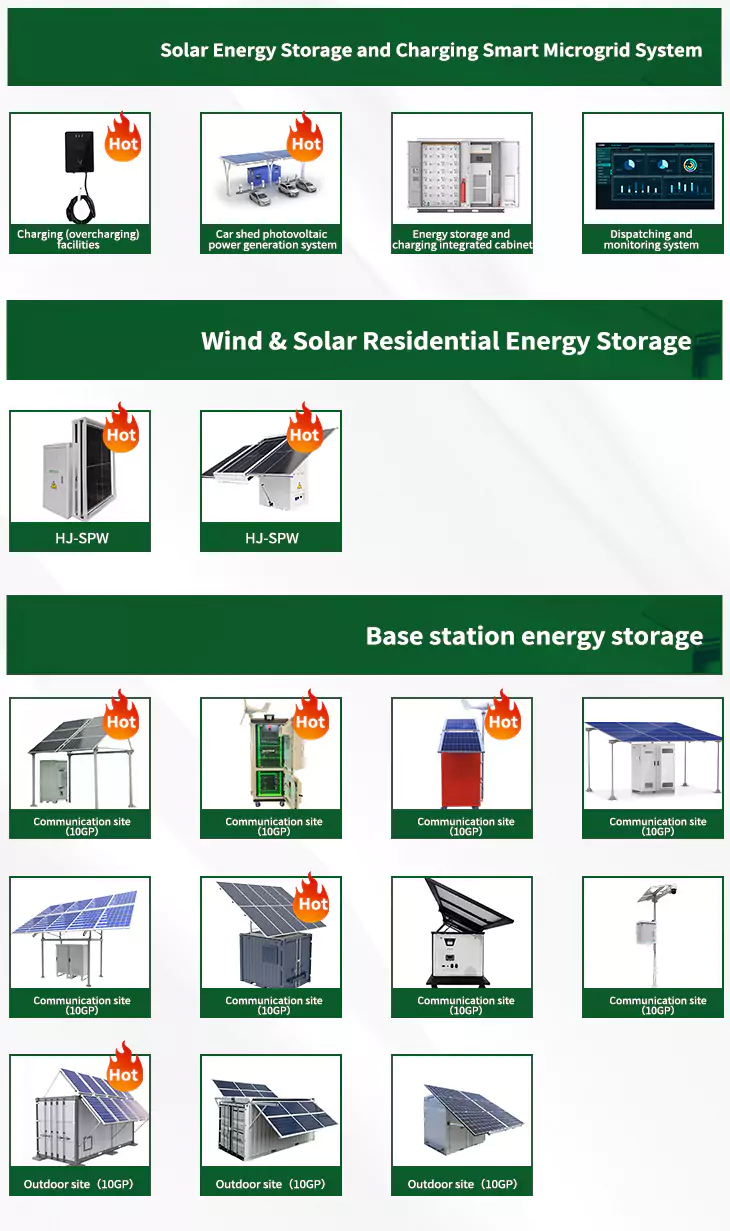

As the photovoltaic (PV) industry continues to evolve, advancements in Energy Storage Iron Lithium New Energy Stocks have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Energy Storage Iron Lithium New Energy Stocks video introduction

When you're looking for the latest and most efficient Energy Storage Iron Lithium New Energy Stocks for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Energy Storage Iron Lithium New Energy Stocks featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Energy Storage Iron Lithium New Energy Stocks]

What are energy storage stocks?

Energy storage stocks are companies that produce or develop energy storage technologies, such as batteries, capacitors, and flywheels. These technologies can store energy from renewable sources like solar and wind power, or from traditional sources like coal and natural gas. What is the best energy storage stock?

Should you buy battery stocks in 2024?

The International Energy Agency predicts a tenfold increase in battery demand for electric vehicles over the next decade. Battery stocks haven't fared well for much of 2024, but a big rally has put them back in the spotlight. The Global X Lithium & Battery Tech ETF (ticker: LIT) gained more than 20% in September.

Should you invest in a lithium battery ETF?

An ETF focused on lithium battery tech will provide diversification across the industry, from lithium mining companies to battery manufacturers to EV automakers that integrate the tech into a vehicle. Since lithium batteries used in larger applications are still undergoing rapid development, there are few choices for ETF pure plays in the industry.

Who owns a lithium fund?

Half the funds are allocated to lithium mining companies, with top lithium producer Albemarle (ALB 0.5%) being the largest holding. A major collection of battery manufacturers based in China and South Korea also dominates the portfolio (Yunnan Energy, Samsung, Panasonic, and LG Chem, to name a few).

What is a lithium & battery technology ETF?

This ETF, as well as competitor Amplify Lithium & Battery Technology ETF (BATT), offer further diversification by including battery and electric vehicle exposure along with pure-play lithium stocks. LIT tracks the Solactive Global Lithium Index and includes Albermarle, along with EV players like Tesla Inc. (TSLA) and BYD Co. Ltd. (1211.HK).

Why should you invest in energy storage stocks?

As the world shifts towards renewable energy, investment in energy storage stocks is becoming increasingly important. Energy storage systems can store excess energy from renewable sources and release it when needed, making them an integral part of a sustainable energy future.