About Lithium battery energy storage device investment estimate

Global demand for Li-ion batteries is expected to soar over the next decade, with the number of GWh required increasing from about 700 GWh in 2022 to around 4.7 TWh by 2030 (Exhibit 1). Batteries for mobility applications, such as electric vehicles (EVs), will account for the vast bulk of demand in 2030—about 4,300 GWh; an.

The global battery value chain, like others within industrial manufacturing, faces significant environmental, social, and governance (ESG).

Some recent advances in battery technologies include increased cell energy density, new active material chemistries such as solid-state batteries, and cell and packaging production technologies, including electrode dry.

Battery manufacturers may find new opportunities in recycling as the market matures. Companies could create a closed-loop, domestic.

The 2030 Outlook for the battery value chain depends on three interdependent elements (Exhibit 12): 1. Supply-chain resilience. A resilient battery value chain is one that is regionalized and diversified. We envision that each.

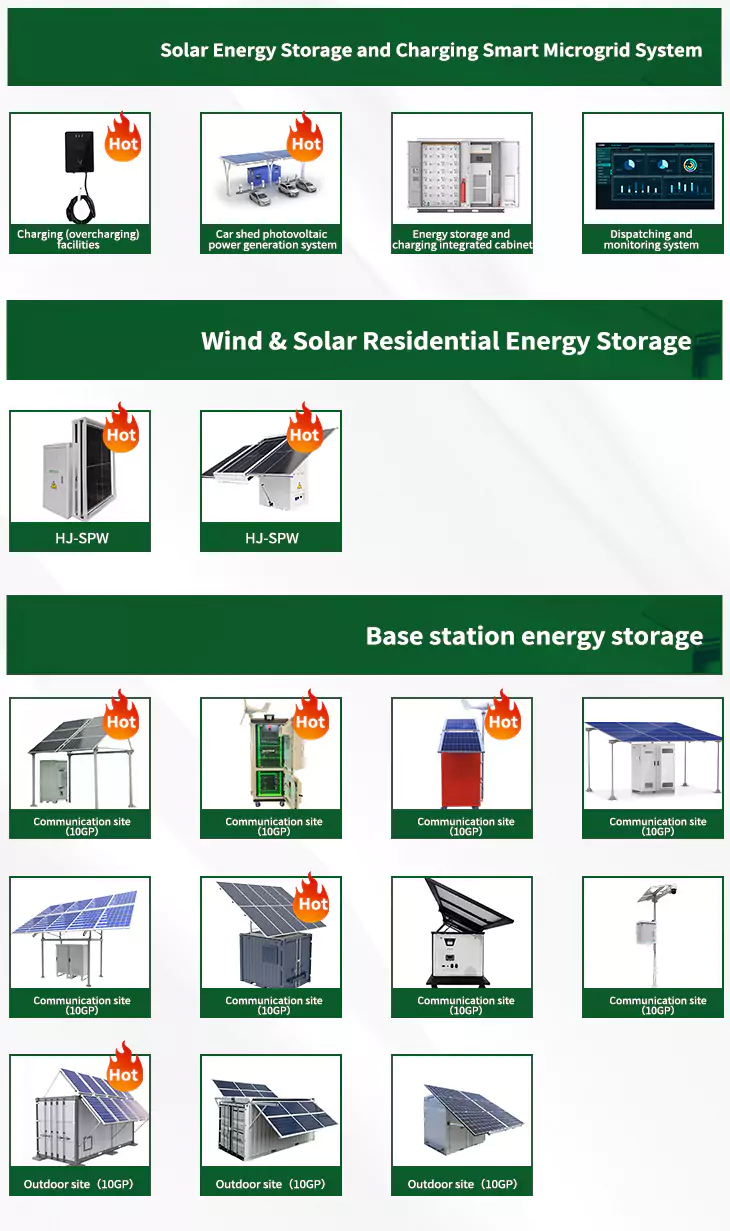

As the photovoltaic (PV) industry continues to evolve, advancements in Lithium battery energy storage device investment estimate have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Lithium battery energy storage device investment estimate video introduction

When you're looking for the latest and most efficient Lithium battery energy storage device investment estimate for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Lithium battery energy storage device investment estimate featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Lithium battery energy storage device investment estimate]

Can lithium ion batteries be adapted to mineral availability & price?

Lithium-ion batteries dominate both EV and storage applications, and chemistries can be adapted to mineral availability and price, demonstrated by the market share for lithium iron phosphate (LFP) batteries rising to 40% of EV sales and 80% of new battery storage in 2023.

What is lithium-ion battery energy storage system?

The penetration of the lithium-ion battery energy storage system (LIBESS) into the power system environment occurs at a colossal rate worldwide. This is mainly because it is considered as one of the major tools to decarbonize, digitalize, and democratize the electricity grid.

What percentage of lithium-ion batteries are used in the energy sector?

Despite the continuing use of lithium-ion batteries in billions of personal devices in the world, the energy sector now accounts for over 90% of annual lithium-ion battery demand. This is up from 50% for the energy sector in 2016, when the total lithium-ion battery market was 10-times smaller.

How much does a lithium battery cost?

Lithium-ion battery prices have declined from USD 1 400 per kilowatt-hour in 2010 to less than USD 140 per kilowatt-hour in 2023, one of the fastest cost declines of any energy technology ever, as a result of progress in research and development and economies of scale in manufacturing.

What is the future of lithium batteries?

The elimination of critical minerals (such as cobalt and nickel) from lithium batteries, and new processes that decrease the cost of battery materials such as cathodes, anodes, and electrolytes, are key enablers of future growth in the materials-processing industry.

What is the bottom-up cost model for battery energy storage systems?

Current costs for utility-scale battery energy storage systems (BESS) are based on a bottom-up cost model using the data and methodology for utility-scale BESS in (Feldman et al., 2021). The bottom-up BESS model accounts for major components, including the LIB pack, inverter, and the balance of system (BOS) needed for the installation.