About Photovoltaic panel stock price forecast for the next 5 years

The best stocks set to capitalize on the solar energy boom, should bullish predictions around the sector come to fruition.

First Solar, Inc. (FSLR) Market cap Trailing 12-month EPS Price/Sales Ratio Enphase Energy, Inc. (ENPH) Market cap Trailing twelve month EPS Price/Sales Ratio SolarEdge Technologies, Inc. (SEDG) Market cap.

We began our search for the best solar power stocks by compiling a list of 25 public companies that are major players in the solar industry. This.

Cory has been a professional trader since 2005, and holds a Chartered Market Technician (CMT) designation. He has been widely published, writing for Technical Analysis of.

As the photovoltaic (PV) industry continues to evolve, advancements in Photovoltaic panel stock price forecast for the next 5 years have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Photovoltaic panel stock price forecast for the next 5 years video introduction

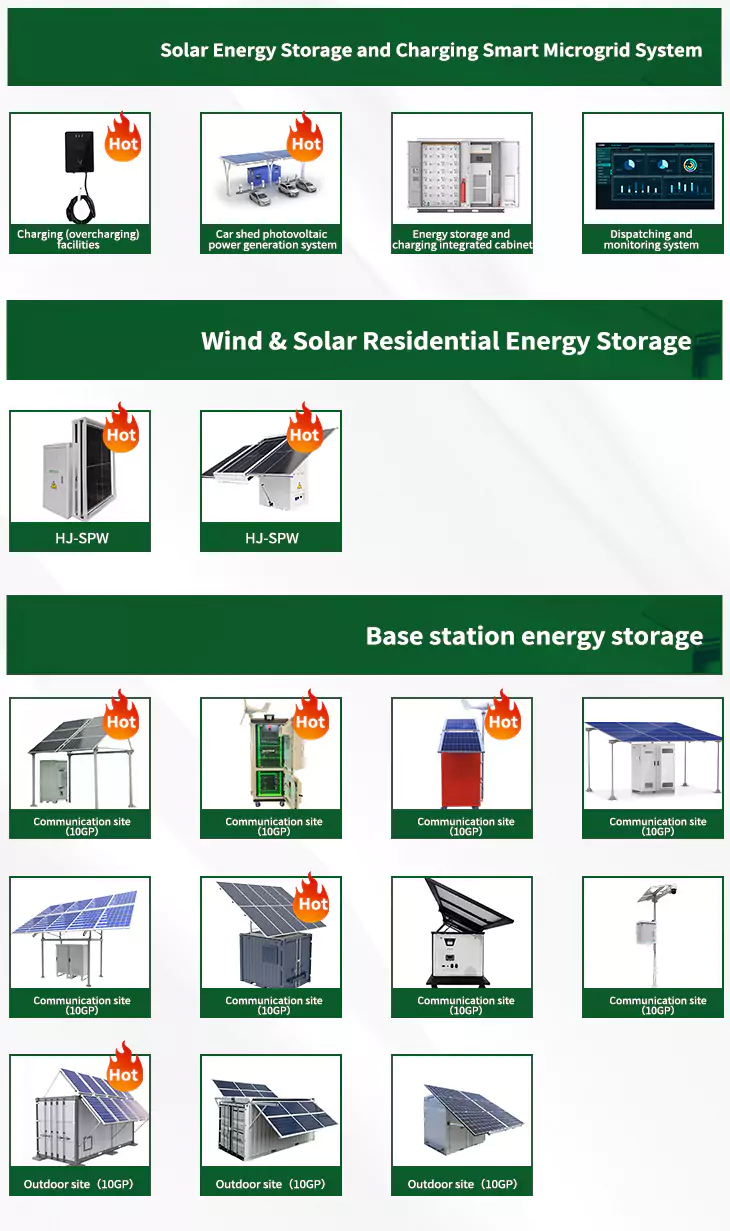

When you're looking for the latest and most efficient Photovoltaic panel stock price forecast for the next 5 years for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Photovoltaic panel stock price forecast for the next 5 years featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Photovoltaic panel stock price forecast for the next 5 years]

Will solar panel prices drop 40% this year?

Tim Buckley, director of Climate Energy Finance, speaks to pv magazine about the current steep trajectory of solar module prices. He estimates that PV panels prices will end up dropping by 40% this year and predicts the closure of old technology and sub-scale solar manufacturing facilities, both in China and globally.

Is rooftop solar a novelty?

As it stands now, rooftop solar is viewed by many as something of a novelty. After all, solar only accounts for 5% of US energy production. But Rumery sees a not-too-distant future where that changes. His organization predicts that, by 2030, about 20% of all US energy production will come from solar.

Are solar panels getting more affordable?

Experts say solar panels have gotten significantly more affordable in the last decade, and new federal incentives will only drive prices lower. There's a big new solar tax credit in town. A federal incentive expanded in 2022 through the Inflation Reduction Act can offset 30% of the cost of a residential solar installation.

Will solar panels save money?

This will likely translate to cost savings for consumers. With economies of scale, and the potential for new domestic solar manufacturing facilities, the solar panels themselves will become cheaper and easier to ship -- addressing some of the international supply chain issues currently facing the industry.

Is Enphase Energy (enph) a good solar stock?

Enphase Energy is among the largest solar stocks by several measures, with a market value more than double some of its peers and annual revenue that will top $1.4 billion this fiscal year. ENPH is also growing dramatically, with fiscal year 2025 revenue set to top $2 billion after an impressive 45% expected growth rate.

Does solar cost a lot?

Solar is not immune to that, and it's causing some modest cost increases for the residential market. "We need supply chains to improve," Rumery said. And despite strong support of solar from the federal government, state-level policies remain something of a patchwork. "The market is heavily influenced by state policy," Rumery said.