About Are photovoltaic panels fixed assets

Power generating equipment is a fixed asset and is principally valued at cost. However, impairment accounting is required in certain cases.

Power generating equipment is a fixed asset and is principally valued at cost. However, impairment accounting is required in certain cases.

In the renewable energy sector, investment in fixed assets, such as solar panels and wind turbines, accounts for the majority of construction costs.

Investment in a solar power plant is in most cases characterized by fixed assets that carry most of the cost.

For solar and other renewable energy businesses, investment in fixed assets accounts for a significant part of the expenditure, for example, solar panels in the case of solar energy.

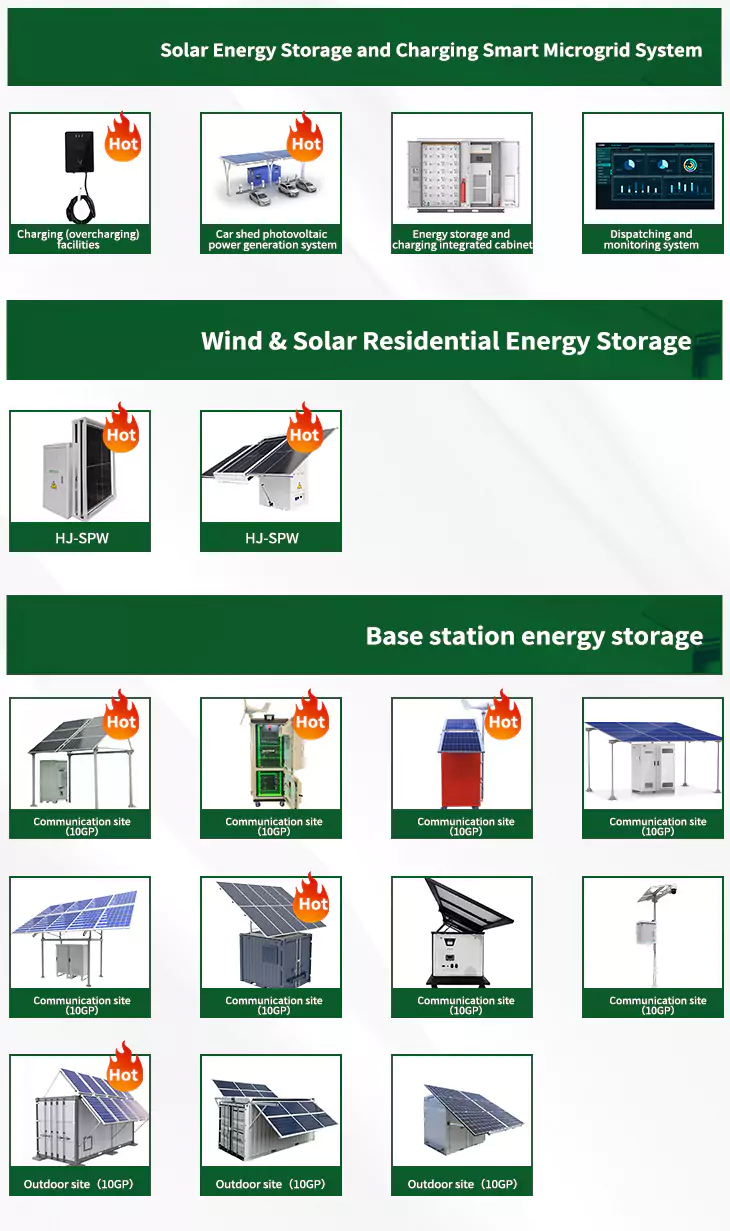

As the photovoltaic (PV) industry continues to evolve, advancements in Are photovoltaic panels fixed assets have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Are photovoltaic panels fixed assets video introduction

When you're looking for the latest and most efficient Are photovoltaic panels fixed assets for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Are photovoltaic panels fixed assets featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Are photovoltaic panels fixed assets ]

Do solar assets need a fair market value?

However, the most common valuations of solar assets will utilize the FMV standard. Fair market value is required for federal income tax purposes (e.g., investment tax credit, and tax allocation of acquisition purchase price) as well as for Section 1603 grant purposes, and is frequently requested by investors.

Can a business benefit from a solar PV system?

Just like individuals, businesses are also able to take the 30% credit from the Inflation Reduction Act to boost tax savings. Like individuals, businesses can receive state rebates and credits as well. These are usually one-time rebates that occur when the solar PV system is purchased.

Can a solar PV system be leased?

The solar PV system was placed in service between January 1, 2006 and December 31, 2023. The solar PV system is at their primary or secondary residence in the United States and the electricity generated does not exceed the home consumption. The homeowner must own the solar PV system. Financed systems qualify, but leased systems do not.

Is power generating equipment a fixed asset?

Power generating equipment is a fixed asset and is principally valued at cost. However, impairment accounting is required in certain cases.

Are solar assets debt financed?

Much like real estate and other long-lived tangible assets, solar assets are generally debt financed with amortizing debt with an amortization period and term that is significantly less than the life of the asset utilized in the DCF projection.

Should solar energy projects be valued?

The valuation of solar energy projects is a complex subject and is a source of tension between regulators, developers and debt and equity investors.