About Brazil photovoltaic panel tax rebate

The Brazilian government approved on Tuesday measures to raise import taxes on photovoltaic modules and wind turbines, in a move that should give a boost to local production of equipment used to.

The Brazilian government approved on Tuesday measures to raise import taxes on photovoltaic modules and wind turbines, in a move that should give a boost to local production of equipment used to.

According to the Brazilian Ministry of Industry and Trade, the government has rescinded the 12% import tax subsidy on photovoltaic components, as the country is also a producer of similar products. Simultaneously, the Brazilian government has revoked over 300 temporary tax reduction measures on solar components, set to be effective within 60 days.

The Brazilian government has raised the import tax rate on solar modules from 9.6% to 25%. Introduced by the Ministry of Development, Industry, Trade and Services (MDIC) this week (12 November .

Brazil's Ministry of Industry and Trade said in a statement that the country's government has eliminated a 12% import tax subsidy for photovoltaic modules because the country also produces similar products.

From pv magazine Brazil. The Brazilian government has raised the import duty on solar modules from 9.6% to 25% this week. According to the Brazilian PV association ABSolar, this measure could .

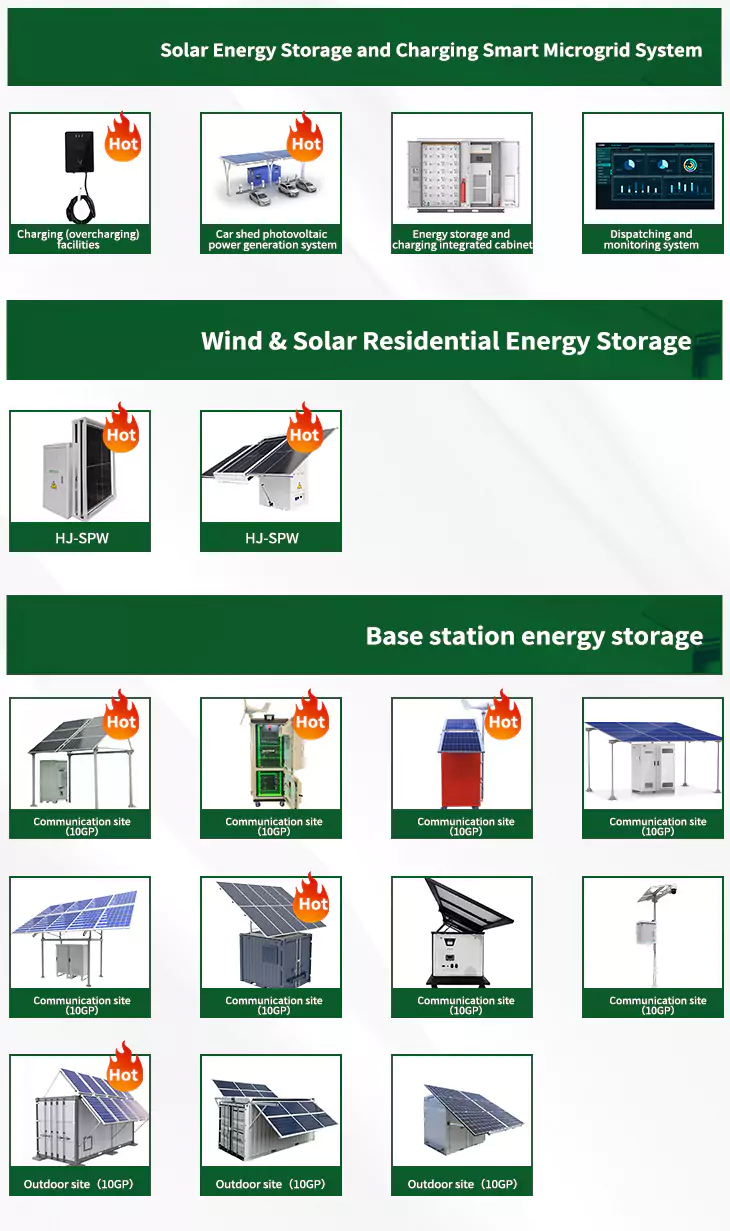

As the photovoltaic (PV) industry continues to evolve, advancements in Brazil photovoltaic panel tax rebate have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Brazil photovoltaic panel tax rebate video introduction

When you're looking for the latest and most efficient Brazil photovoltaic panel tax rebate for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Brazil photovoltaic panel tax rebate featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Brazil photovoltaic panel tax rebate]

Will Brazil raise import taxes on photovoltaic modules & wind turbines?

REUTERS/Bruno Kelly Purchase Licensing Rights SAO PAULO, Dec 12 (Reuters) - The Brazilian government approved on Tuesday measures to raise import taxes on photovoltaic modules and wind turbines, in a move that should give a boost to local production of equipment used to generate renewable energy.

When will Brazil reintroduce a 12% import tariff on photovoltaic components?

Brazil Reinstates 12% Import Tariff on Photovoltaic Components! On December 12, the Brazilian government approved measures to increase import tariffs on photovoltaic components and wind turbines, citing the promotion of local renewable energy equipment production. The measures are set to take effect on January 1, 2024.

Does Brazil have a solar import tax?

However, on August 1, 2020, the Brazilian government eliminated all import tariffs on foreign-manufactured solar photovoltaic equipment, reducing the import tax rate to 0%. In 2022, China's total exports of photovoltaic products to Brazil amounted to $4.8 billion, with inverters contributing $800 million.

Does Brazil impose a tariff on solar panels?

Looking back at the industry's history, Brazil had imposed a hefty 12% tariff on imported solar components and a 14% tariff on inverters. However, on August 1, 2020, the Brazilian government eliminated all import tariffs on foreign-manufactured solar photovoltaic equipment, reducing the import tax rate to 0%.

When will Brazil revoke solar tax reductions?

The measure will come into effect on Jan. 1. The government also revoked more than 300 temporary tax reductions on solar modules, effective in 60 days. Brazil produces some of the equipment used to generate solar energy, which has already become the second-largest source of electricity in the country.

Will a new tax on Chinese solar panels affect Brazil?

Comments containing hate speech, obscenity, and personal attacks will not be approved. For years, Brazil has relied on Chinese solar panels to power its green energy transition. With a new tax on solar energy equipment imports, this industry could be shaken.