About Average gross profit margin of photovoltaic bracket industry

The photovoltaic (PV) bracket market is a critical segment within the solar energy industry, providing the structural support necessary to position solar panels at optimal angles for energy production.

The photovoltaic (PV) bracket market is a critical segment within the solar energy industry, providing the structural support necessary to position solar panels at optimal angles for energy production.

Comparing a company's gross profit margin to industry averages and other financial metrics such as operating margin and net profit can help determine a suitable ratio for that specific business. Industry Averages Profit Margins. The average gross and net profit margins can vary significantly across different industries.

Since 2015, the average gross profit margin of the whole industry has increased year by year, and as the gap between the added value created by the two ends and the central region has continued to widen, the “Smile Curve” of the PV industry value chain has gradually deepened.

To get a good sense of what makes a good gross margin, we will examine the average gross profit margin by industry over 22 years of data from the S&P 500. It’s not always absolute gross margin that is most important when looking at this formula, but rather a comparison between peers.

The future trends of PV industry are predicted based on the evolution of the influencing factors. If guided by existing policies, the PV installed capacity will stabilize at 403 GW in 2025.

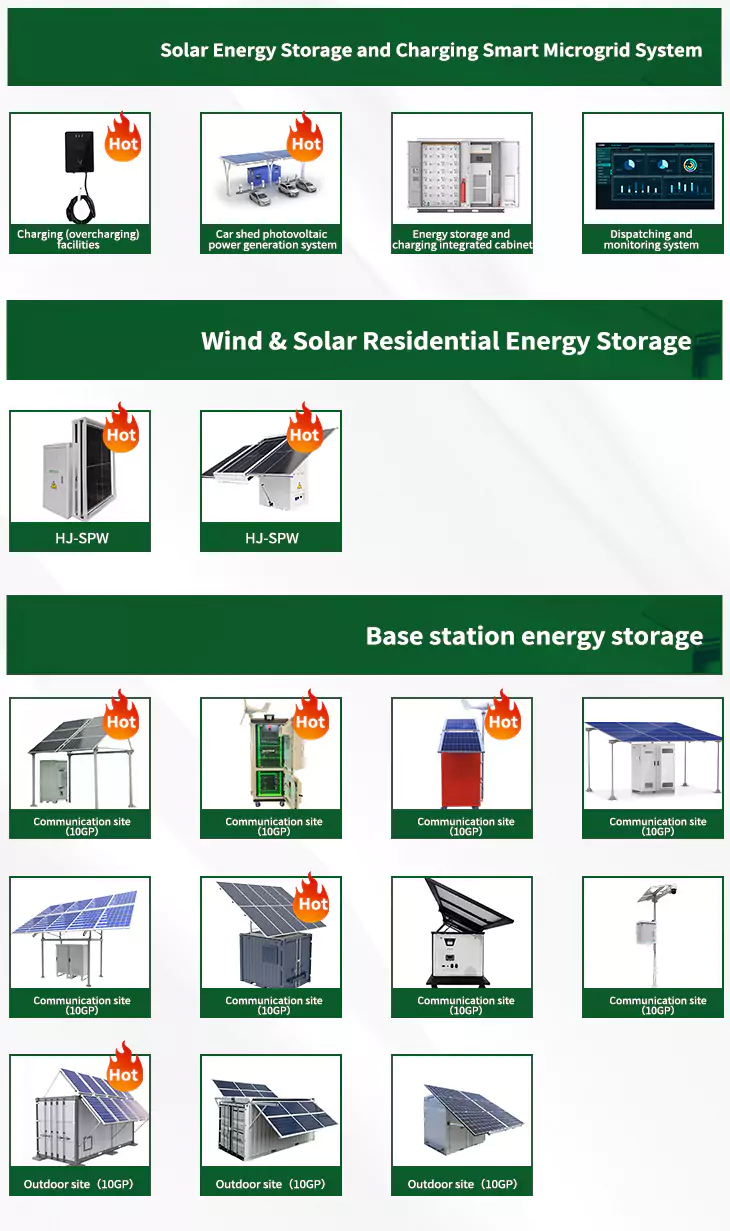

As the photovoltaic (PV) industry continues to evolve, advancements in Average gross profit margin of photovoltaic bracket industry have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

About Average gross profit margin of photovoltaic bracket industry video introduction

When you're looking for the latest and most efficient Average gross profit margin of photovoltaic bracket industry for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Average gross profit margin of photovoltaic bracket industry featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Average gross profit margin of photovoltaic bracket industry]

How profitable is PV Manufacturing?

Broadly speaking, the PV manufacturing environment has been challenging in terms of overall profitability. Since 2010, gross margins have varied between 5% and 25%, while operating margins have varied between 15% and -15% (Feldman, O'Shaughnessy et al. 2020).

What constitutes a gross margin in PV Manufacturing?

The operating margin, R&D expenses, and SG&A expenses together constitute the gross margin. Broadly speaking, the PV manufacturing environment has been challenging in terms of overall profitability.

Where can I find a report on photovoltaic modules?

This report is available at no cost from the National Renewable Energy Laboratory (NREL) at Smith, Brittany L., Michael Woodhouse, Kelsey A. W. Horowitz, Timothy J. Silverman, Jarett Zuboy, and Robert M. Margolis. 2021. Photovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework Results.

How can a company gain insights from gross profit margins?

To gain insights from gross profit margins, it is essential to establish industry-specific benchmarks and consider broader business strategies. Comparing a company's gross profit margin to industry averages and other financial metrics such as operating margin and net profit can help determine a suitable ratio for that specific business.

What is the difference between gross profit margin and net profit margin?

Overall, while gross profit margin and net profit margin are both important metrics, they provide different insights into a company's financial health and performance. It's essential to consider both when evaluating a company's profitability and to compare them to industry benchmarks and other financial metrics to get a complete picture.

How does cost structure affect Gross and net profit margins?

Industry: Different industries have different cost structures, which can affect both gross and net profit margins. For example, manufacturing companies may have higher COGS due to raw material costs, while service-based companies may have lower COGS but higher operating expenses.